Learn About FICA, Social Security, and Medicare Taxes

Por um escritor misterioso

Last updated 26 outubro 2024

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn about what FICA taxes are, withholding Social Security and Medicare taxes from employee pay, and how to calculate, report, and pay FICA taxes to the IRS.

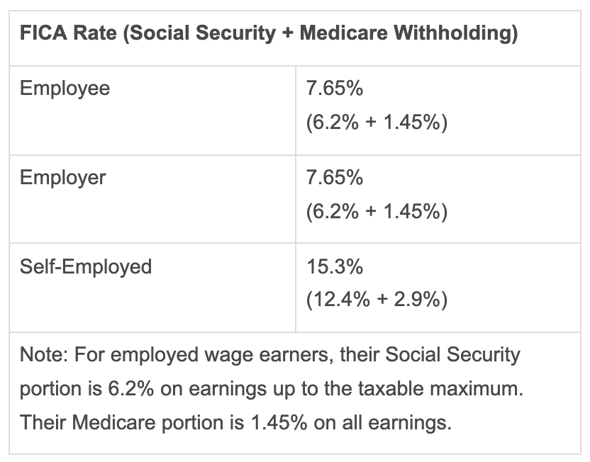

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

Overview of FICA Tax- Medicare & Social Security

2021 Wage Base Rises for Social Security Payroll Taxes

Learn About FICA Tax and How To Calculate It

How to Pay Social Security and Medicare Taxes: 10 Steps

What are FICA Taxes? Social Security & Medicare Taxes Explained

What Is FICA Tax: How It Works And Why You Pay

2023 Social Security Wage Base Increases to $160,200

What is the FICA Tax and How Does it Connect to Social Security?

What is FICA Tax? - The TurboTax Blog

FICA Tax Exemption for Nonresident Aliens Explained

Social Security and Medicare • Teacher Guide

2021 Wage Cap Rises for Social Security Payroll Taxes

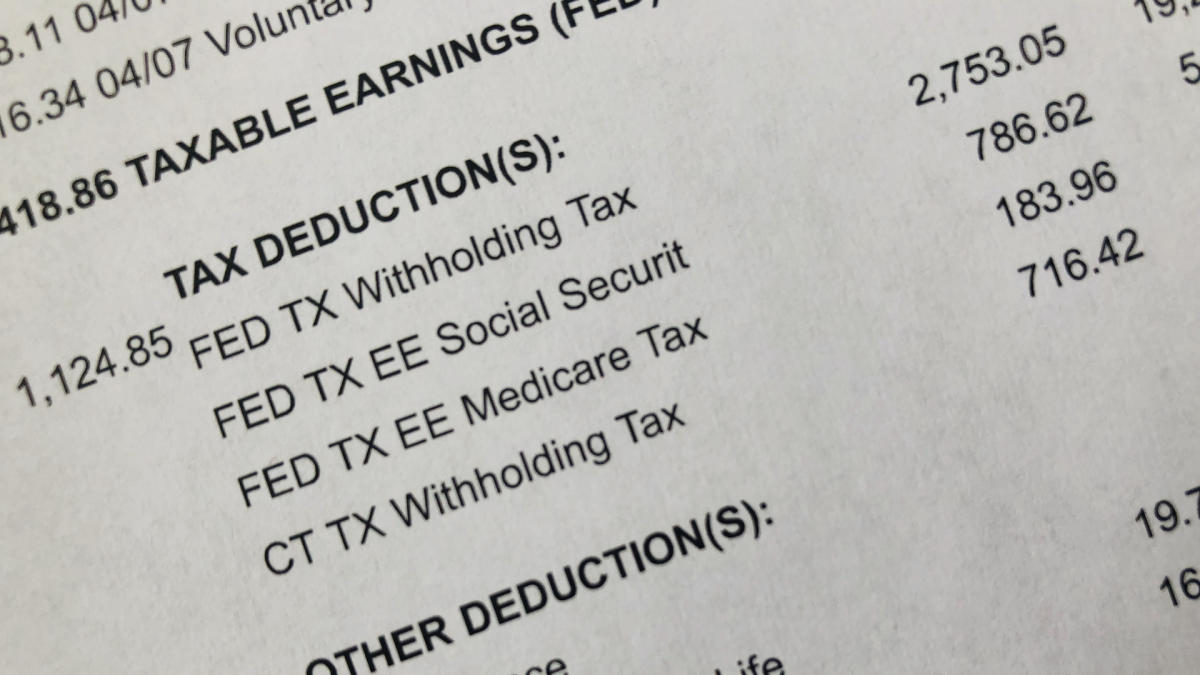

What is FED MED/EE Tax?

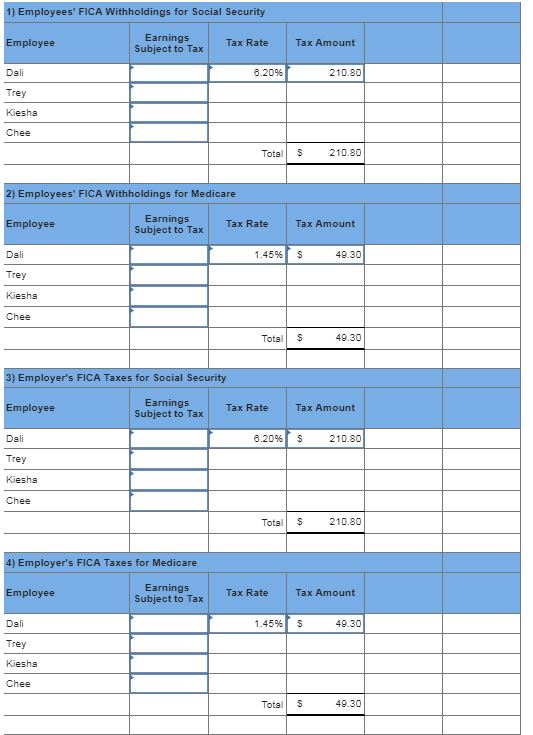

Solved Paloma Co. has four employees. FICA Social Security

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions26 outubro 2024

-

What is FICA Tax? - Optima Tax Relief26 outubro 2024

What is FICA Tax? - Optima Tax Relief26 outubro 2024 -

What is the FICA Tax and How Does It Work? - Ramsey26 outubro 2024

What is the FICA Tax and How Does It Work? - Ramsey26 outubro 2024 -

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)26 outubro 2024

Federal & Medicare FICA Tax Table Maintenance (FEDM2 & FEDS2)26 outubro 2024 -

FICA Refund: How to claim it on your 1040 Tax Return?26 outubro 2024

FICA Refund: How to claim it on your 1040 Tax Return?26 outubro 2024 -

Do You Have To Pay Tax On Your Social Security Benefits?26 outubro 2024

Do You Have To Pay Tax On Your Social Security Benefits?26 outubro 2024 -

Withholding FICA Tax on Nonresident employees and Foreign Workers26 outubro 2024

Withholding FICA Tax on Nonresident employees and Foreign Workers26 outubro 2024 -

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student26 outubro 2024

How to get your FICA tax REFUND?, Form 843 & Form 8316, F1 Student, International Student26 outubro 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine26 outubro 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine26 outubro 2024 -

FICA Tax Tip Fairness Pro Beauty Association26 outubro 2024

FICA Tax Tip Fairness Pro Beauty Association26 outubro 2024

você pode gostar

-

Batman fans on twitter should be oppressed like gamers : r/batman26 outubro 2024

Batman fans on twitter should be oppressed like gamers : r/batman26 outubro 2024 -

Top 10 Best PS4 Games Of All Time26 outubro 2024

Top 10 Best PS4 Games Of All Time26 outubro 2024 -

quanzhi fashi season 6 ep 13|TikTok Search26 outubro 2024

-

Death Note: L Lawliet - death note post - Imgur26 outubro 2024

Death Note: L Lawliet - death note post - Imgur26 outubro 2024 -

Szombathelyi Haladás26 outubro 2024

-

/do0bihdskp9dy.cloudfront.net/09-04-2023/t_855b6c4325194571bbcd88288b5b3372_name_2_SERIOUSLY_INJURED_IN_2_CAR_CRASH_scaled.jpg) 2 seriously injured in 2-car crash in Vancouver26 outubro 2024

2 seriously injured in 2-car crash in Vancouver26 outubro 2024 -

XSS Refletido Payload - DVWA26 outubro 2024

XSS Refletido Payload - DVWA26 outubro 2024 -

I KNEW YOU WERE TROUBLE. LYRICS by TAYLOR SWIFT: once upon a time26 outubro 2024

-

TIM Group - Wikipedia26 outubro 2024

TIM Group - Wikipedia26 outubro 2024 -

Badges - Canvas Badges26 outubro 2024