Breaking Down The Impact Of UK's Value Added Tax On Sellers

Por um escritor misterioso

Last updated 24 outubro 2024

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

What is the difference between sales tax and VAT?

UK VAT changes from 1 January 2021- CaptainBI Blog

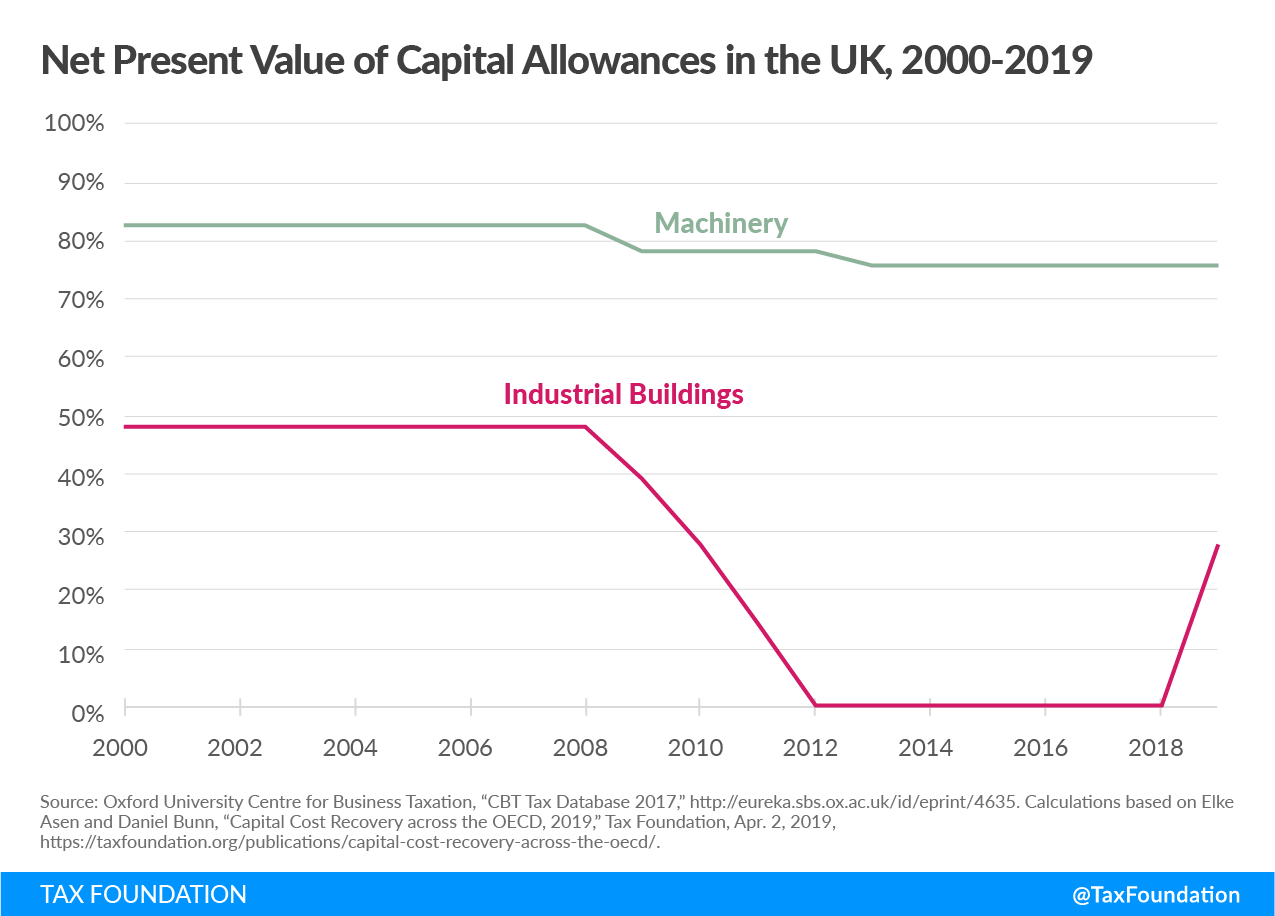

UK Taxes: Potential for Growth, 2019

Sales tax – Knowledge Base

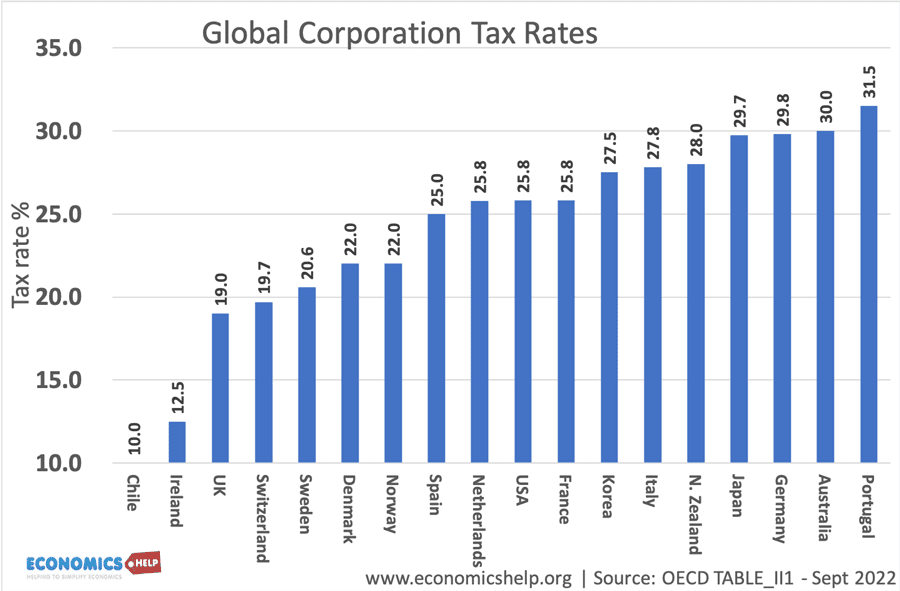

The effect of tax cuts on economic growth and revenue - Economics Help

:max_bytes(150000):strip_icc()/brexit.asp_final-23d572e0478542dfa7f2493350540677.png)

Brexit Meaning and Impact: The Truth About the U.K. Leaving the EU

:max_bytes(150000):strip_icc()/Value-Added-Tax-bfc9359a52f74ae9a430d4c2d7ce91e2.jpg)

Value-Added Tax (VAT)

Shareholder Value Added

Effects of Taxes

Sales Tax: Definition, How It Works, How To Calculate It

The effect of tax cuts on economic growth and revenue - Economics Help

Crypto Tax UK: Expert Guide 2023

Taxation in the United States - Wikipedia

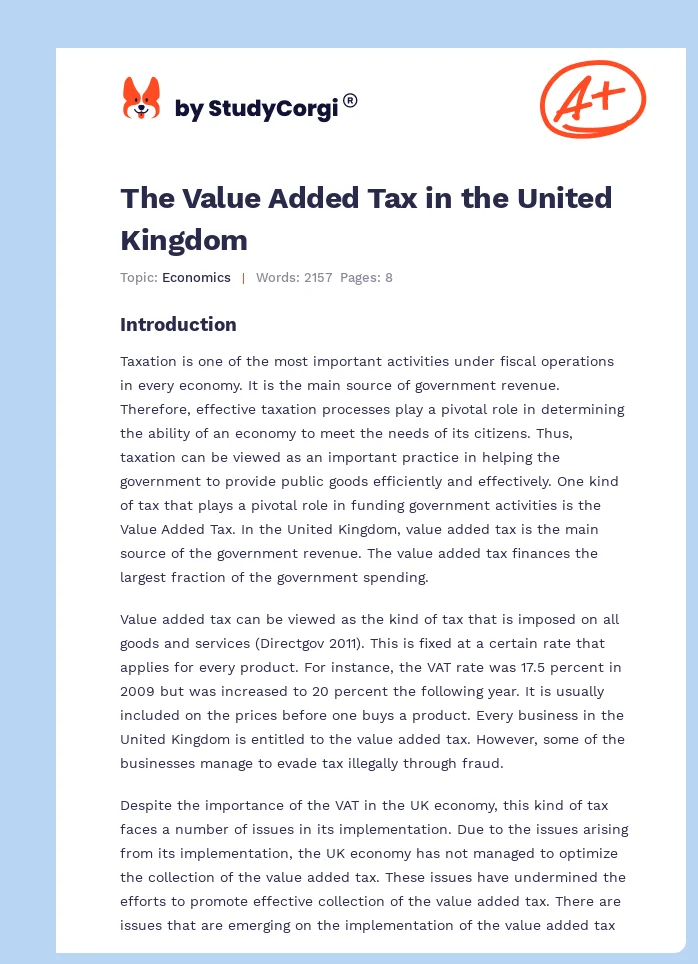

The Value Added Tax in the United Kingdom

Value-added tax - Wikipedia

Recomendado para você

-

Completes Acquisition of Motors.co.uk24 outubro 2024

Completes Acquisition of Motors.co.uk24 outubro 2024 -

opens physical pop-up store to reinvent the UK high street - Elite Business Magazine24 outubro 2024

opens physical pop-up store to reinvent the UK high street - Elite Business Magazine24 outubro 2024 -

7 TIPS FOR SETTING UP BUSINESS ACCOUNT - Seed Formations24 outubro 2024

7 TIPS FOR SETTING UP BUSINESS ACCOUNT - Seed Formations24 outubro 2024 -

Automatically importing Orders24 outubro 2024

Automatically importing Orders24 outubro 2024 -

latest news, analysis and trading updates24 outubro 2024

latest news, analysis and trading updates24 outubro 2024 -

New Apple iPhone 11 64GB Purple MWLX2B/A LTE 4G Sim Free Unlocked24 outubro 2024

New Apple iPhone 11 64GB Purple MWLX2B/A LTE 4G Sim Free Unlocked24 outubro 2024 -

Announces First UK High Street Concept Store24 outubro 2024

Announces First UK High Street Concept Store24 outubro 2024 -

.co.uk - Is UK Down Right Now?24 outubro 2024

.co.uk - Is UK Down Right Now?24 outubro 2024 -

Who is UK's new general manager Eve Williams? - Internet Retailing24 outubro 2024

Who is UK's new general manager Eve Williams? - Internet Retailing24 outubro 2024 -

The Book: Essential tips for buying and selling on .co.uk24 outubro 2024

The Book: Essential tips for buying and selling on .co.uk24 outubro 2024

você pode gostar

-

![I'm Dangerous 「AMV」🔥 [ Fire Force ]](https://i.ytimg.com/vi/wOE2YfaJAtQ/maxresdefault.jpg) I'm Dangerous 「AMV」🔥 [ Fire Force ]24 outubro 2024

I'm Dangerous 「AMV」🔥 [ Fire Force ]24 outubro 2024 -

![FNaF2/SFM] Withered Foxy by Zoinkeesuwu on DeviantArt](https://images-wixmp-ed30a86b8c4ca887773594c2.wixmp.com/f/599743c7-9070-437a-bf99-ab244f60455b/dfgunk9-a7d86012-5278-4a3a-b8fa-1c8ae97a3918.png/v1/fill/w_791,h_1010/_fnaf2_sfm__withered_foxy_by_zoinkeesuwu_dfgunk9-pre.png?token=eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzI1NiJ9.eyJzdWIiOiJ1cm46YXBwOjdlMGQxODg5ODIyNjQzNzNhNWYwZDQxNWVhMGQyNmUwIiwiaXNzIjoidXJuOmFwcDo3ZTBkMTg4OTgyMjY0MzczYTVmMGQ0MTVlYTBkMjZlMCIsIm9iaiI6W1t7ImhlaWdodCI6Ijw9MTYzMyIsInBhdGgiOiJcL2ZcLzU5OTc0M2M3LTkwNzAtNDM3YS1iZjk5LWFiMjQ0ZjYwNDU1YlwvZGZndW5rOS1hN2Q4NjAxMi01Mjc4LTRhM2EtYjhmYS0xYzhhZTk3YTM5MTgucG5nIiwid2lkdGgiOiI8PTEyODAifV1dLCJhdWQiOlsidXJuOnNlcnZpY2U6aW1hZ2Uub3BlcmF0aW9ucyJdfQ.AQ8JgJHxHuJdfODeYzhYYxiA27gaPsAuFDYNvbEdPrg) FNaF2/SFM] Withered Foxy by Zoinkeesuwu on DeviantArt24 outubro 2024

FNaF2/SFM] Withered Foxy by Zoinkeesuwu on DeviantArt24 outubro 2024 -

Jogo do Bicho by BGaming Free Demo Play24 outubro 2024

Jogo do Bicho by BGaming Free Demo Play24 outubro 2024 -

Pokemon: O Filme - Mewtwo Contra Ataca by alexlima1095 on DeviantArt24 outubro 2024

Pokemon: O Filme - Mewtwo Contra Ataca by alexlima1095 on DeviantArt24 outubro 2024 -

Não devemos usar nem dizer o nome de Deus em vão24 outubro 2024

Não devemos usar nem dizer o nome de Deus em vão24 outubro 2024 -

⚽️✓COPA DO MUNDO 2022: 5 Ideias Lúdicas Educação Infantil e Ensino Fundamental24 outubro 2024

⚽️✓COPA DO MUNDO 2022: 5 Ideias Lúdicas Educação Infantil e Ensino Fundamental24 outubro 2024 -

Bolo tema Beyblade para o aniversariante Arthur! @graziiellamachadoo gratos pela preferência! #bolodecorado #boloconfeitado #cake #cakedesign, By L&G cakes24 outubro 2024

-

The Princess of Light, Kakumeiki Valvrave Wiki24 outubro 2024

The Princess of Light, Kakumeiki Valvrave Wiki24 outubro 2024 -

Placa Decorativa PVC Para Caminhão Tenha Fé24 outubro 2024

Placa Decorativa PVC Para Caminhão Tenha Fé24 outubro 2024 -

Reagimos As Referências das poses de JOJO!24 outubro 2024

Reagimos As Referências das poses de JOJO!24 outubro 2024