Online gaming industry for 28% GST on gross gaming revenue not on entry amount

Por um escritor misterioso

Last updated 05 novembro 2024

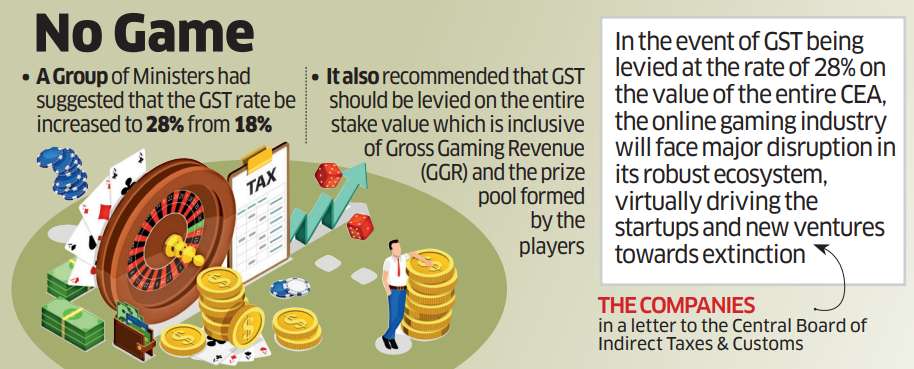

GGR is the fee charged by an online skill gaming platform as service charges to facilitate the participation of players in a game on their platform while Contest Entry Amount (CEA) is the entire amount deposited by the player to enter a contest on the platform.

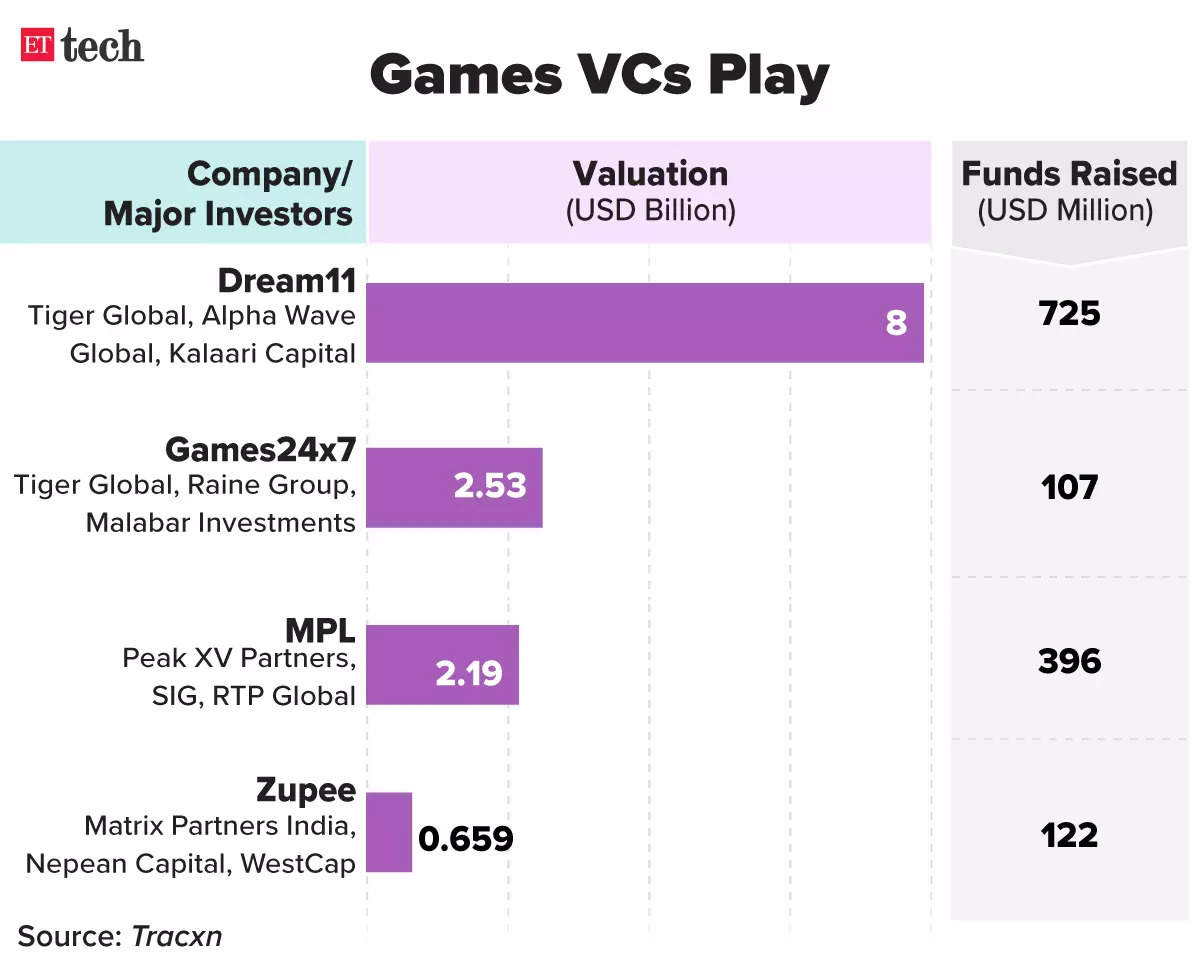

India's $3-billion Online Gaming Industry is Battling the Odds

Online Real Money Gaming Gets Equated with Gambling In Taxation

Countries With Thriving Online Gaming Industry Levy GST On Gross

online gaming investors news: Online gaming investors say 28% GST

28% GST on ONLINE GAMING – Revenue generating tool or Will it lead

Will 28% GST kill the online gaming industry in India?

The GST council today announced levying 28% taxes on online gaming

GST Council decides to levy 28% tax on online gaming, horse racing

Online gaming industry for 28% GST on gross gaming revenue not on

gst: Top gaming firms urge government not to raise GST rate to 28

Recomendado para você

-

Online Gaming Platforms Features of Various Online Gaming Platforms05 novembro 2024

Online Gaming Platforms Features of Various Online Gaming Platforms05 novembro 2024 -

Online gaming platforms05 novembro 2024

Online gaming platforms05 novembro 2024 -

Gaming Startup Awon GameZ Raises Funds To Launch Online Marketplace05 novembro 2024

Gaming Startup Awon GameZ Raises Funds To Launch Online Marketplace05 novembro 2024 -

How gaming platforms have become the new social media05 novembro 2024

How gaming platforms have become the new social media05 novembro 2024 -

Cross platform play online gaming concept icon Vector Image05 novembro 2024

Cross platform play online gaming concept icon Vector Image05 novembro 2024 -

Online gaming platform, casino and gambling business. Cards, dice and multi-colored game pieces on laptop keyboard. Sports & Recreation Stock Photos05 novembro 2024

Online gaming platform, casino and gambling business. Cards, dice and multi-colored game pieces on laptop keyboard. Sports & Recreation Stock Photos05 novembro 2024 -

Customize Your Own Online Game Platform Orion Stars/Noble/Juwa /Golden Dragon Online Game App Software Online Fishing Gaming USA - AliExpress05 novembro 2024

Customize Your Own Online Game Platform Orion Stars/Noble/Juwa /Golden Dragon Online Game App Software Online Fishing Gaming USA - AliExpress05 novembro 2024 -

explores online gaming for its platform - Neowin05 novembro 2024

explores online gaming for its platform - Neowin05 novembro 2024 -

Cross platform play, online gaming concept icon. Server connection, internet multiplayer idea thin line illustration. Esports, video game competition Stock Vector Image & Art - Alamy05 novembro 2024

Cross platform play, online gaming concept icon. Server connection, internet multiplayer idea thin line illustration. Esports, video game competition Stock Vector Image & Art - Alamy05 novembro 2024 -

Skill-based Games for Real Money: Top Websites to Play and Earn05 novembro 2024

Skill-based Games for Real Money: Top Websites to Play and Earn05 novembro 2024

você pode gostar

-

Luminosity Gaming and Club Deportivo Guadalajara Forge Strategic05 novembro 2024

Luminosity Gaming and Club Deportivo Guadalajara Forge Strategic05 novembro 2024 -

Limited Edition IRON MAN Avengers Endgame Sticker05 novembro 2024

Limited Edition IRON MAN Avengers Endgame Sticker05 novembro 2024 -

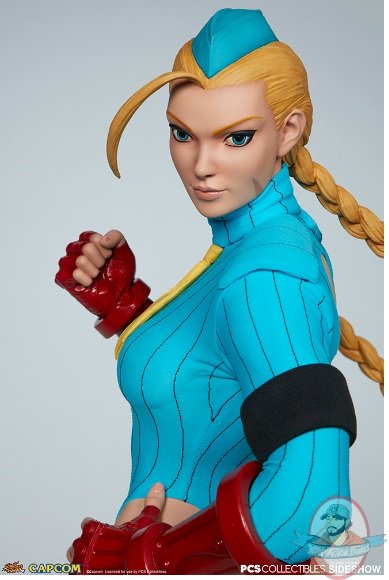

1/3 Scale Street Fighter Cammy Killer Bee Statue Pop Culture05 novembro 2024

1/3 Scale Street Fighter Cammy Killer Bee Statue Pop Culture05 novembro 2024 -

rap gojo satoru takeru|Pesquisa do TikTok05 novembro 2024

-

ice ice fruit blox fruits05 novembro 2024

ice ice fruit blox fruits05 novembro 2024 -

AeC abre mais 600 vagas em Mossoró e região - Portal NE905 novembro 2024

AeC abre mais 600 vagas em Mossoró e região - Portal NE905 novembro 2024 -

POPETPOP Pet Training Clicker Button 2Pc Dog Sound Trainer Pet Training Accessory Wrist Band Tool Whistle Click for Puppy Dog Red * Blue Push Clickers Button Clicker : מוצרים לחיות מחמד05 novembro 2024

POPETPOP Pet Training Clicker Button 2Pc Dog Sound Trainer Pet Training Accessory Wrist Band Tool Whistle Click for Puppy Dog Red * Blue Push Clickers Button Clicker : מוצרים לחיות מחמד05 novembro 2024 -

iPhone Giveaway of the Day - Random Giveaway Picker Spinner05 novembro 2024

iPhone Giveaway of the Day - Random Giveaway Picker Spinner05 novembro 2024 -

Your Love Guitar Lesson - The Outfield05 novembro 2024

Your Love Guitar Lesson - The Outfield05 novembro 2024 -

GTA 6 release date: Forget leaks, just check out what this analyst said05 novembro 2024

GTA 6 release date: Forget leaks, just check out what this analyst said05 novembro 2024