Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 25 outubro 2024

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

Abating IRS penalties - Journal of Accountancy

For those who pay estimated taxes, second quarter June 15 deadline approaches – Larson Accouting

What is an IRS Accuracy Related Penalty?

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

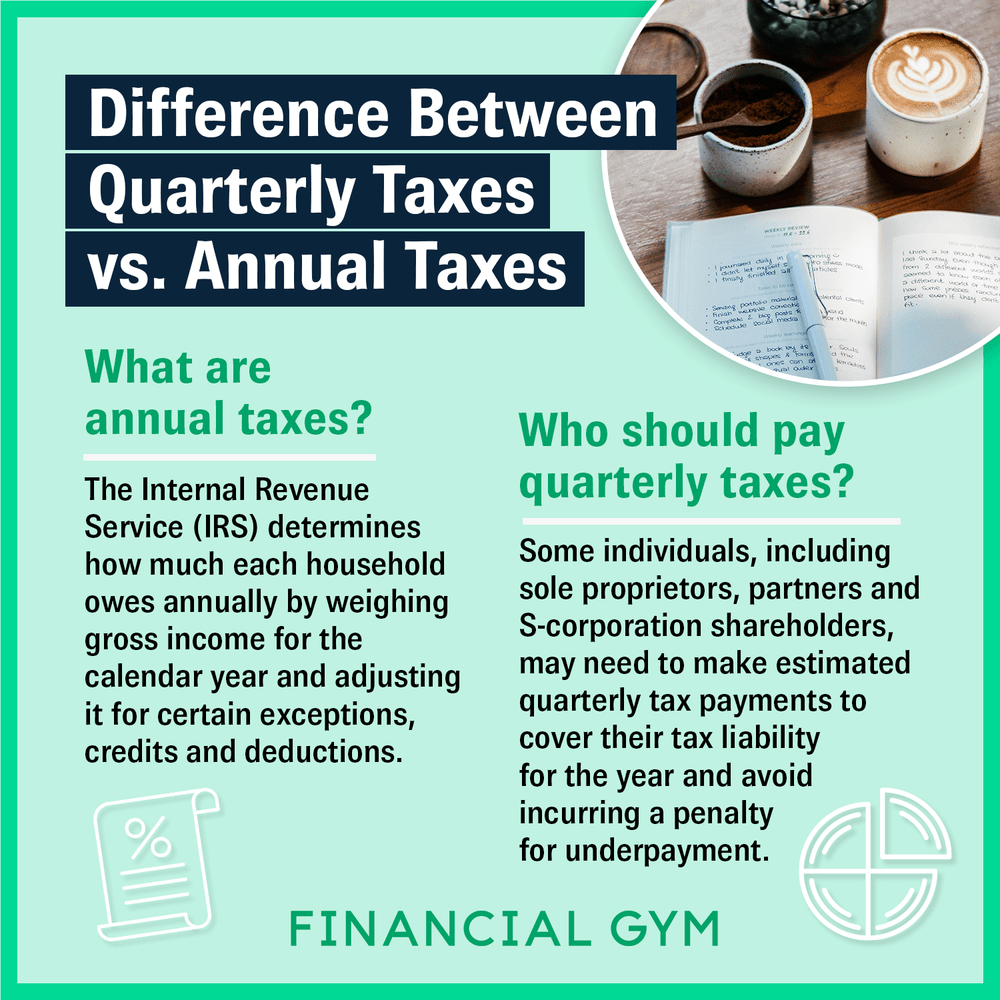

What's the Difference Between Quarterly Taxes vs. Annual Taxes?

What Is the IRS Underpayment Penalty?

What Happens If You Miss a Quarterly Estimated Tax Payment?

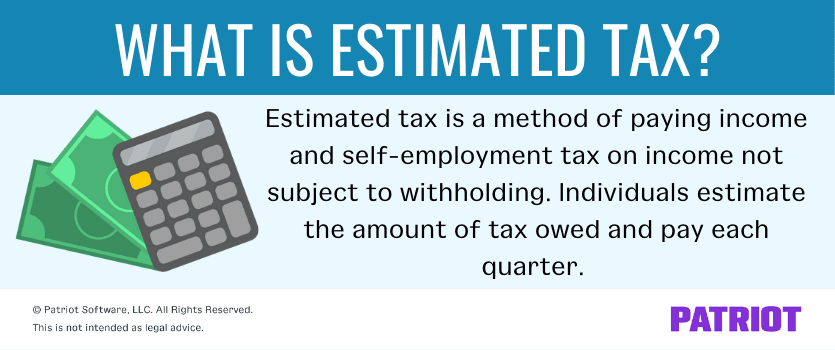

Estimated Tax Penalty: The Correct Way to Make Estimated Tax Payments for 2021

How to Avoid the Underpayment Penalty for Estimated Taxes

What Is Estimated Tax? Calculations, Penalties, & More

Recomendado para você

-

Penalty shootouts are unfair. Here's how they could be fairer, View25 outubro 2024

Penalty shootouts are unfair. Here's how they could be fairer, View25 outubro 2024 -

World Cup penalty shootout rules: Explaining the format, history25 outubro 2024

World Cup penalty shootout rules: Explaining the format, history25 outubro 2024 -

Penalty kicks: What, when, why and other rules25 outubro 2024

Penalty kicks: What, when, why and other rules25 outubro 2024 -

World Cup final: How Argentina won penalty shootout25 outubro 2024

World Cup final: How Argentina won penalty shootout25 outubro 2024 -

/cdn.vox-cdn.com/uploads/chorus_asset/file/24220217/GettyImages_980216674.jpg) Where to aim a penalty kick - Vox25 outubro 2024

Where to aim a penalty kick - Vox25 outubro 2024 -

/origin-imgresizer.eurosport.com/2022/12/09/3505600-71459168-2560-1440.jpg) Croatia 1-1 Brazil AET (Croatia win 4-2 on penalties): Dominik25 outubro 2024

Croatia 1-1 Brazil AET (Croatia win 4-2 on penalties): Dominik25 outubro 2024 -

/cdn.vox-cdn.com/uploads/chorus_image/image/72804243/1761707981.0.jpg) Ronald Araujo says Barcelona should have had a penalty in El25 outubro 2024

Ronald Araujo says Barcelona should have had a penalty in El25 outubro 2024 -

Cristiano Ronaldo breaks Saudi duck with stoppage time penalty to25 outubro 2024

-

How many penalties have there been at the World Cup 2022?25 outubro 2024

How many penalties have there been at the World Cup 2022?25 outubro 2024 -

England 1-2 France: Kane's penalty miss, Lloris breaks record25 outubro 2024

England 1-2 France: Kane's penalty miss, Lloris breaks record25 outubro 2024

você pode gostar

-

HTML Aula1, PDF, Html25 outubro 2024

-

46 Clothing for slender roblox ideas roblox, roblox shirt, create an avatar25 outubro 2024

46 Clothing for slender roblox ideas roblox, roblox shirt, create an avatar25 outubro 2024 -

Download Scary Face with Red Hair and Bloody Eyes PNG Online - Creative Fabrica25 outubro 2024

Download Scary Face with Red Hair and Bloody Eyes PNG Online - Creative Fabrica25 outubro 2024 -

Pretend meaning in Hindi and simple English, Synonyms25 outubro 2024

Pretend meaning in Hindi and simple English, Synonyms25 outubro 2024 -

Dragon Ball Text to Speech:Bring Your Favorite Characters to Life25 outubro 2024

Dragon Ball Text to Speech:Bring Your Favorite Characters to Life25 outubro 2024 -

/i.s3.glbimg.com/v1/AUTH_59edd422c0c84a879bd37670ae4f538a/internal_photos/bs/2022/F/Y/OY1Y26SVaRGTftCXJGAw/0081marcos-amend-1024x683.jpeg) Macaco-aranha-de-cara-branca, que vive no Parque Cristalino, em MT25 outubro 2024

Macaco-aranha-de-cara-branca, que vive no Parque Cristalino, em MT25 outubro 2024 -

Android Apps by Try Hard Gаmes on Google Play25 outubro 2024

-

Four Corners Back To School Ice Breaker Activity25 outubro 2024

Four Corners Back To School Ice Breaker Activity25 outubro 2024 -

RoPro Roblox Extension on X: To celebrate hitting 100k RoPro25 outubro 2024

RoPro Roblox Extension on X: To celebrate hitting 100k RoPro25 outubro 2024 -

Ant Man Marvel Snap Card Variant - Marvel Snap Zone25 outubro 2024

Ant Man Marvel Snap Card Variant - Marvel Snap Zone25 outubro 2024