Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 30 outubro 2024

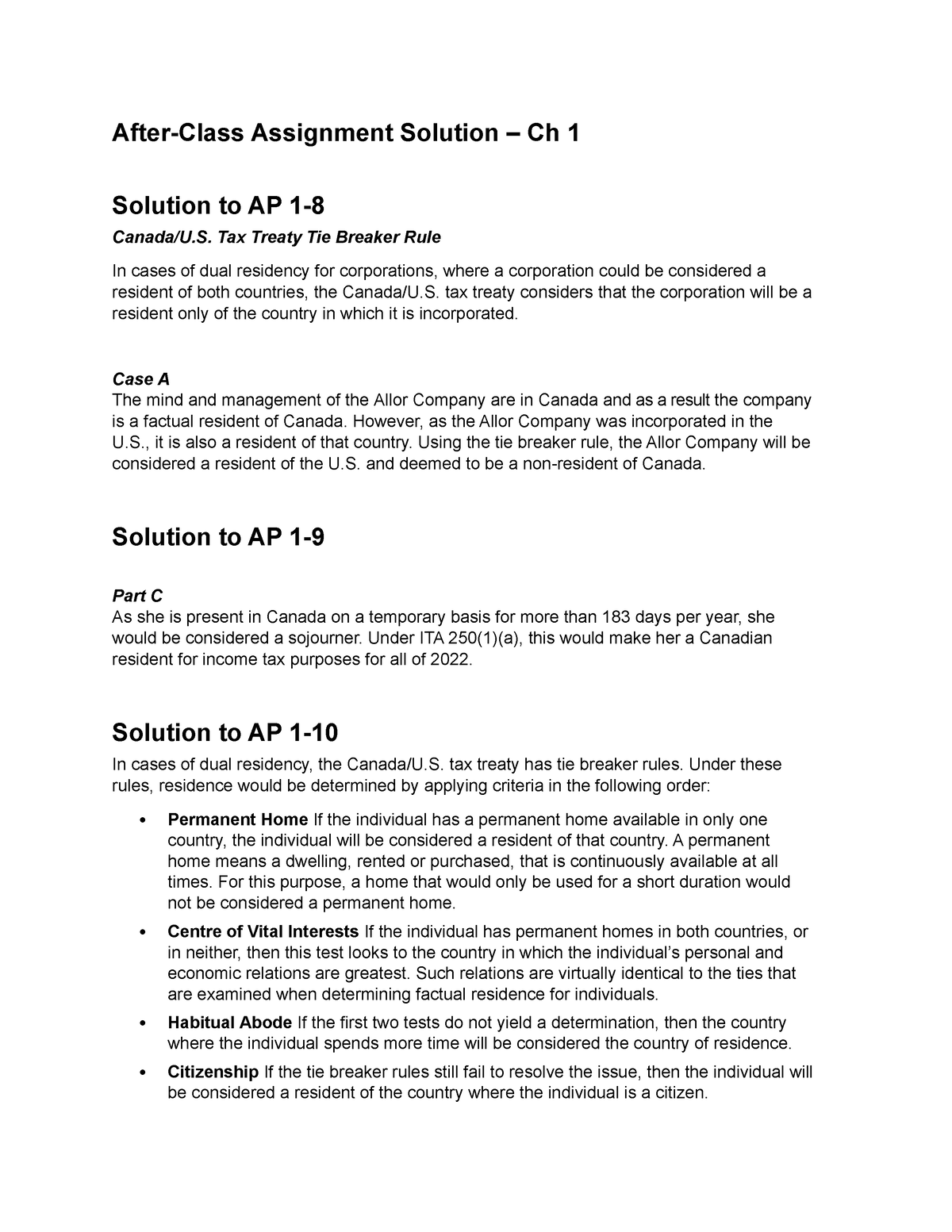

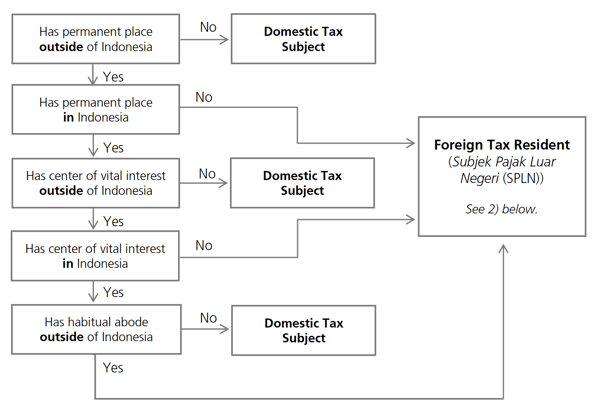

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

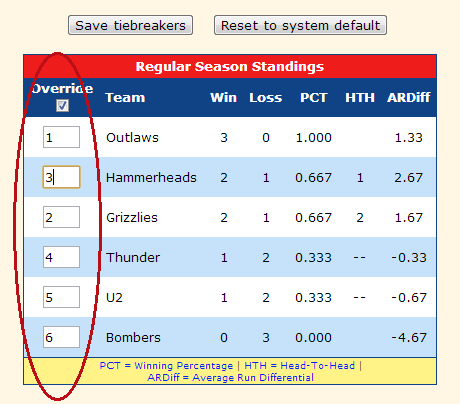

Residency Tie Breaker Rules & Relevance

Tax Treaty Tie Breaker Provision

Week 2 Ch1 Assignment Solution - After-Class Assignment Solution – Ch 1 Solution to AP 1- Canada/U. - Studocu

THE IMPACT OF THE COMMUNICATIONS REVOLUTION ON THE APPLICATION OF PLACE OF EFFECTIVE MANAGEMENT AS A TIE BREAKER RULE - PDF Free Download

Chapter 8 Are Tax Treaties Worth It for Developing Economies? in: Corporate Income Taxes under Pressure

Dual residence and tax treaties' tie-breaker rules: Can a temporary accommodation amount to habitual abode?

What being an Australian resident for tax purposes means for you

Indonesia's Omnibus Law - Individual Tax Subjects

Relief Under Section 90/90a/91 of Income Tax Act, DTAA

Recomendado para você

-

Tie-Breaker Help Guide30 outubro 2024

Tie-Breaker Help Guide30 outubro 2024 -

Tie-Breakers – QuizNightHQ30 outubro 2024

Tie-Breakers – QuizNightHQ30 outubro 2024 -

TIE BREAKER30 outubro 2024

TIE BREAKER30 outubro 2024 -

Tie Breaker Oregon30 outubro 2024

-

Tie Breaker Coming Soon SVG | Baby Announcement SVG30 outubro 2024

Tie Breaker Coming Soon SVG | Baby Announcement SVG30 outubro 2024 -

Tie Breaker Park - Visit Hopkinsville – Christian County30 outubro 2024

Tie Breaker Park - Visit Hopkinsville – Christian County30 outubro 2024 -

$300,000 price drop on 31m Hatteras motor yacht Tie Breaker30 outubro 2024

$300,000 price drop on 31m Hatteras motor yacht Tie Breaker30 outubro 2024 -

Tie Breaker, Bandipedia30 outubro 2024

-

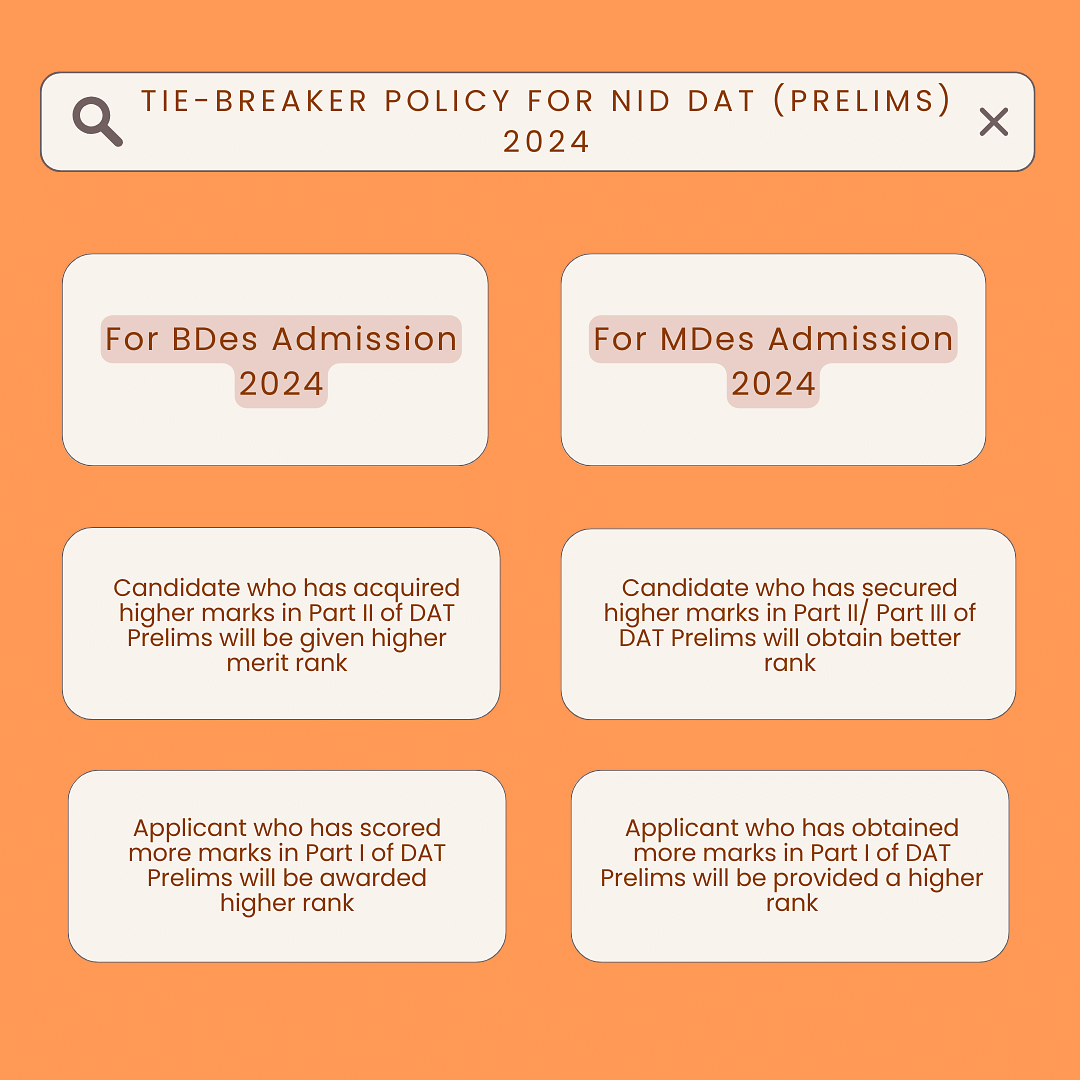

NID 2024 Tie-Breaker Policy30 outubro 2024

NID 2024 Tie-Breaker Policy30 outubro 2024 -

Tie Breaker Number Two - Baby Dodge Number Five! — Vox Clara Family30 outubro 2024

Tie Breaker Number Two - Baby Dodge Number Five! — Vox Clara Family30 outubro 2024

você pode gostar

-

Livro de Passatempo Coquetel Palavras Cruzadas Nível Fácil - Livros de Entretenimento - Magazine Luiza30 outubro 2024

Livro de Passatempo Coquetel Palavras Cruzadas Nível Fácil - Livros de Entretenimento - Magazine Luiza30 outubro 2024 -

Základní škola a mateřská škola Pardubice-Pardubičky, Kyjevská 2530 outubro 2024

Základní škola a mateřská škola Pardubice-Pardubičky, Kyjevská 2530 outubro 2024 -

Review: Zach's The Rocky Horror Show Still Tasteless, Plotless, Pointless, and Perfect: Cult classic is a welcome jump to the left, step to the right - Arts - The Austin Chronicle30 outubro 2024

Review: Zach's The Rocky Horror Show Still Tasteless, Plotless, Pointless, and Perfect: Cult classic is a welcome jump to the left, step to the right - Arts - The Austin Chronicle30 outubro 2024 -

Animes Brasil - Animes Online APK + Mod for Android.30 outubro 2024

Animes Brasil - Animes Online APK + Mod for Android.30 outubro 2024 -

Subway Surfers Match - Baixar APK para Android30 outubro 2024

Subway Surfers Match - Baixar APK para Android30 outubro 2024 -

Ignited Freddy from The Joy of Creation easter egg in FNAF Security Breach : r/fivenightsatfreddys30 outubro 2024

Ignited Freddy from The Joy of Creation easter egg in FNAF Security Breach : r/fivenightsatfreddys30 outubro 2024 -

Bleach: Thousand-Year Blood War Shares Episode 5 Details30 outubro 2024

Bleach: Thousand-Year Blood War Shares Episode 5 Details30 outubro 2024 -

Jingle Bell – música e letra de MC Teteu30 outubro 2024

-

POMB (@pomb_) / X30 outubro 2024

-

The rake30 outubro 2024

The rake30 outubro 2024